As U.S. tax season swings into gear, it’s a good time to take a closer look at one of the most useful niche benefits of using our software: simplifying tax reporting for real estate transactions.

InfoTrack’s roots in Australia began with property orders, so it’s no surprise that this is a key feature.

But while some customers may be aware of our powerful integration with Easysoft real estate software—which makes it possible to file pre-filled tax forms in seconds—many might be surprised to learn that 1099-S filing can be done from any InfoTrack-integrated software, with several advantages over filing your forms the traditional way.

Faster filing

InfoTrack’s integrations with Easysoft, LEAP and Smokeball allow users to populate 1099-S forms with saved information about proceeds from real estate transactions.

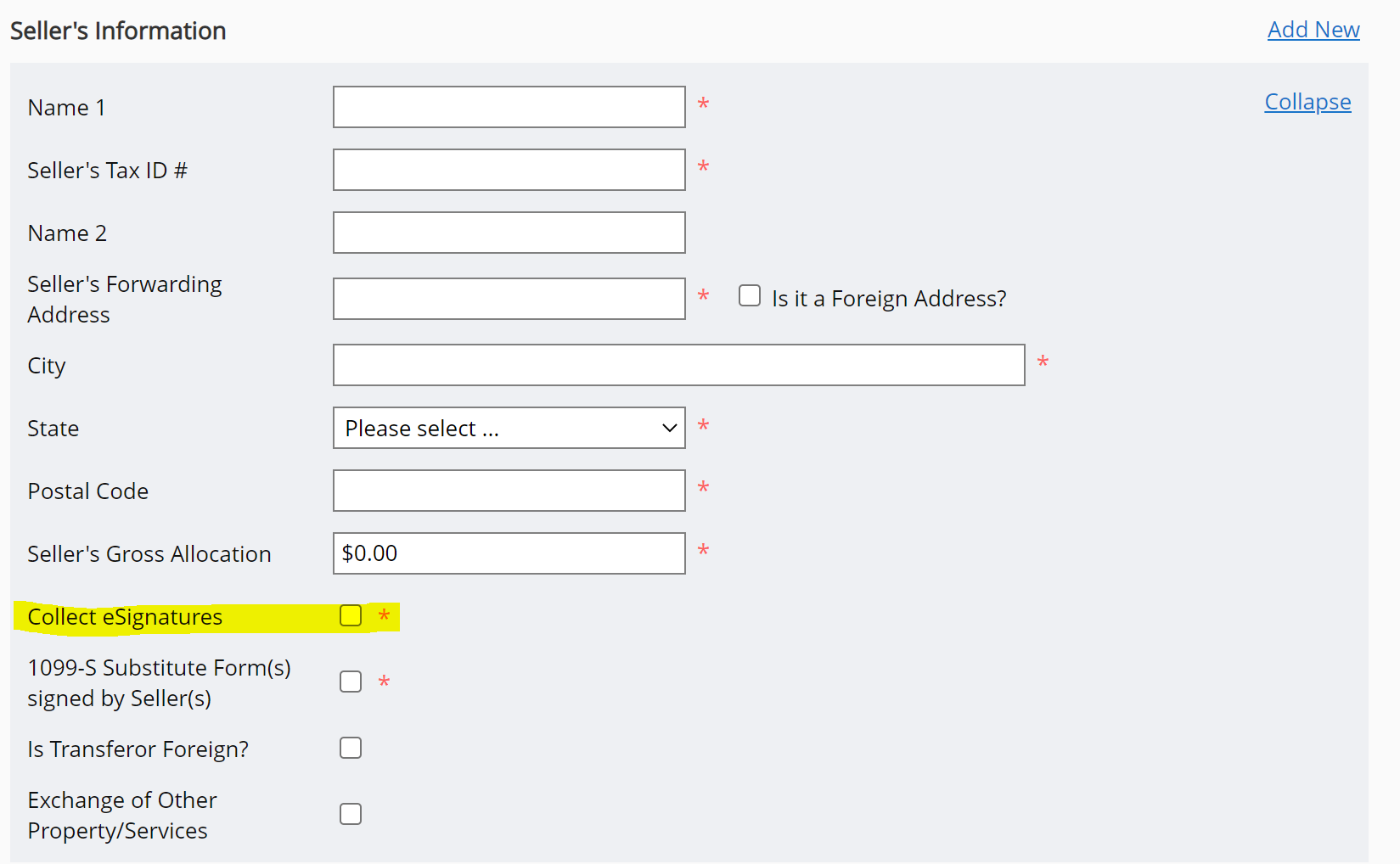

When a new real estate matter is created in these softwares, the matter fields may include information that is required on a 1099-S form, such as:

- Date of closing

- Gross proceeds

- Address of property

- Buyer’s part of real estate tax

- Filer’s information

- Name

- Tax identification number

- Address

- Transferor’s tax identification number

- Name

- Tax identification number

- Address

If the information is present in the matter fields, it can be pre-populated on an electronic 1099-S form submission, saving the filer time and the risk of errors.

Documents stay in your matter

While not all of InfoTrack’s integration partners have the ability to save real estate transaction data, they all can file documents saved in a matter with the IRS and can receive filed copies back automatically.

From there, they can be signed electronically using SignIT and provided to the transferor as a statement, as required by law.

Expenses recorded automatically

As with all InfoTrack order types, expenses from your 1099-S order can be automatically logged to the connected matter in your integrated software, where they can be easily passed through on an invoice.

Which 1099-S features are available in which integrations?

| Pre-filled forms | Synced documents | Logged expenses | |

| Clio Manage | x | x | |

| Easysoft | x | x | x |

| iManage | x | ||

| LEAP | x | x | x |

| NetDocuments | x | ||

| Smokeball | x | x | x |

| Time Matters | x | x |

When are 1099-S filings due for 2024 real estate sales?

While InfoTrack’s automated workflow makes it easy to get all your 1099-S filing done immediately at the time of the sale, there are some important deadlines to keep in mind if you’d rather process them all around the same time.

January 31, 2025

All 1099-S forms for 2024 closings must be submitted to InfoTrack.

Early February

Copies of forms are mailed to sellers by InfoTrack on your behalf, to be received by mid-February.

February 28, 2025

Corrections and late filings may be made for 2024 closings on this day only. However, you (the filer) are responsible for furnishing the seller a copy of the form.

Early March

All 1099-S forms for 2024 closings are submitted to the IRS by InfoTrack. Any subsequent corrections after this date may incur a late fee.

How to get started

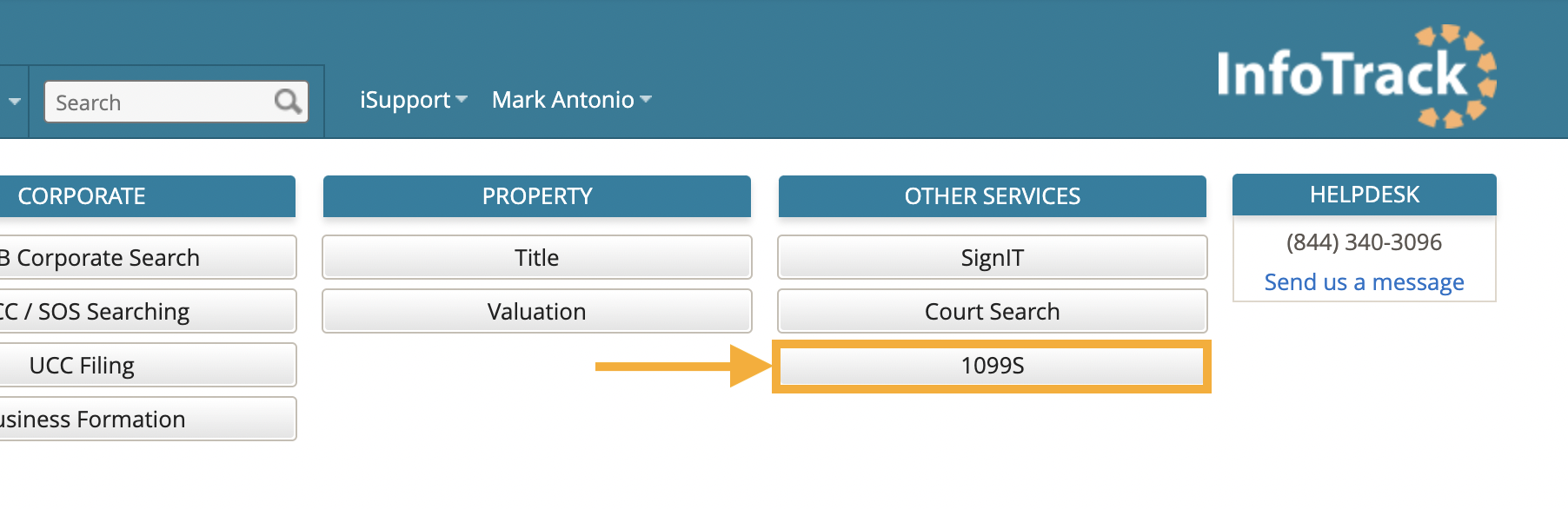

While 1099-S filing can be accessed stand-alone by any InfoTrack user, launching the workflow from an integrated software will provide the most benefits.

When InfoTrack is connected to your legal software, you will often see a “1099-S” order type available in the action menu for each document in your matter. Because the workflow can differ slightly in various integrations, we recommend contacting your InfoTrack account representative to walk you through your first order.

Author

Alex Braun is a Product Marketing Manager with a passion for legal technology. His focus is on making sure InfoTrack builds new products and features that help make the litigation lifecycle simpler and more efficient. Alex is a graduate of the University of Missouri School of Journalism and the recipient of the Illinois Paralegal Association's 2018 Outstanding Sustaining Member Award.

View all posts